|

Sample pages |

| Executive summary | Industry overview | Supplier profile | Product gallery | ||||

| China is the largest

and one of the most price-competitive suppliers of children's wear

in the world. The industry, however, is currently in a state of

flux as it deals with numerous challenges, including the export

restrictions to the US and the EU, a government-imposed export tax,

increasing material costs and labor shortages.

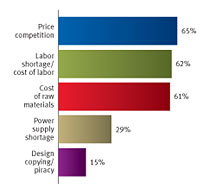

Exports of newborns' clothing and babywear sharply increased after quotas were partially lifted in 2002 and total overseas shipments of children's wear have continued to rise steadily in the succeeding years. In the first four months after the last phase of quota removal in January 2005, children's wear exports to the US and the EU increased by 30 percent over the corresponding period in the previous year. The surge in exports was expected, and to alleviate concerns of disruption in the US and EU markets, the government of China imposed a levy on more than 100 types of apparel, including children's wear. Since the beginning of the year, exported garments have been taxed at US$0.024 to US$0.060 per piece. However, the export tax failed to limit the dramatic surge in exports, forcing the US to impose safeguards on a number of categories, including some types of toddlers' and schoolchildren's apparel. As of July, the US had restricted four categories including cotton and man-made fiber knitted shirts, cotton trousers, and cotton and man-made fiber underwear. The quota for cotton knitted shirts, cotton trousers and underwear has already been met, while boys' woven cotton shirts have used up more than half of their allocated share. In the case of EU, China agreed to limit export volume growth by 10 to 12.5 percent till the end of 2007. The quota for pullovers has already been reached, while that for knitted shirts, boys' trousers, girls' woven shirts and dresses are fast approaching their limits. Although children's wear suppliers in China were anticipating the safeguards, the restrictions have nevertheless adversely affected the industry. The quota limits on apparel categories apply not only to children's garments, but to men's, women's and children's combined. This has resulted in fierce competition not only among children's wear makers but with adult garment suppliers as well. The situation has forced companies to rethink their business strategies. Many suppliers have put their capacity expansion plans on hold, adopting a wait-and-see policy. Instead, companies are trying to boost exports to other markets such as Japan and the Middle East. Some large suppliers are moving production to other countries in Asia. Meanwhile, a few are shipping goods to countries such as Bangladesh and Mexico, to be re-exported to the US and the EU. However, this effectively raises the price of garments, making them less competitive than apparel from other countries not affected by the new US and EU quotas, such as India and Vietnam. Aside from the concerns arising from US and EU safeguards, suppliers have had to deal with other issues. The cost of cotton, the main material used for children's wear, increased 30 percent in 2004 and by an additional 10 percent during the first half of this year. However, keen competition has prevented makers from raising product prices, even on value-added models. Many large companies have in fact lowered the prices of their basic designs by 10 percent in response to rival makers not only in China but in other garment- exporting countries such as India and Vietnam as well. Instead of inflating prices, these large suppliers are looking at ways to reduce production costs. Some of them are computerizing processes to increase efficiency and cut costs. Companies expect that investing in these new machines will enable them to reduce material wastage, minimize rejection rates and lower export prices. In addition, the export tax, which is levied on a volume basis, has adversely affected suppliers focusing on low-end garments. Many of them are upgrading R&D capability to release value-added models, which yield higher profits. And more... To see the full Industry Overview order now.

|

|

|||

|

|

| All information contained in China Sourcing Reports is the result of original, independent and impartial research conducted by Global Sources analysts. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. If you have questions about the report or status of your orders, please e-mail Xue Mei for further assistance. |

| The Children's Wear Sourcing report has been developed and maintained by Global Sources. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. |

Apparel

Search

Add Your Company

Contact Us

About Us

Advertise

News Letter

Legal

Help

Copyright © 1999-2023 Apparel Search Company. All Rights Reserved.