|

Sample pages |

| Executive summary | Industry overview | Supplier profile | Product gallery | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China exported 956.9

million watches worth US$977.4 million in 2004. However, export

growth rates in the industry have been decreasing dramatically.

Export sales last year increased by only 2.5 percent, significantly

lower than the 22.4 percent growth rate registered in 2003. Even

volume growth has slowed. Where total outbound shipments increased

10 percent in 2003, they rose only 5.4 percent in 2004.

The downward trend is continuing in 2005. Exports in the first seven months of 2005 were down 7.7 percent to US$460.9 million from the same period in 2004. The number of pieces shipped fell 13.7 percent to 418.6million. One of the main reasons for the decrease in exports is the decline in demand for low-end watches including promotional models.

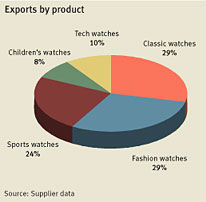

Aside from the usual calendar and alarm functions, these watches have value-added functions such as USB flash disks drives, digital cameras, MP3 players, laser pointers, pedometers, heart-rate monitors, radios and even universal TV remote controls. Watchmakers in China produce promotional, classic, fashion, sports, children's and tech watches. These are also the scope of this report. While most suppliers offer a range of watches across all categories, some specialize in one or two lines. More than 61 percent of the suppliers in this report produce at least four kinds of watches for export, usually with classic, fashion and sports designs as the major lines. Nineteen percent specialize in one or two categories, usually children's or tech models. The features and prices of each kind of watch are discussed according to low end, midrange and high end in the Products & Prices section. The R&D module discusses how makers are improving product development and design capability as a means to be more competitive. The Materials & Components section explains sourcing of movements, modules and other materials, and how this affects overall product quality. The Manufacturing section details the production and QC processes in small, midsize and large companies. Most watch suppliers in China are locally owned. Sixty-eight percent of companies profiled in this report are private locally owned. Hong Kong-owned or invested companies comprise 22 percent and a few are Taiwan-owned or invested. And more... To see the full Executive Summary order now.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

| All information contained in China Sourcing Reports is the result of original, independent and impartial research conducted by Global Sources analysts. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. If you have questions about the report or status of your orders, please e-mail Xue Mei for further assistance. |

| The Watches Sourcing report from China has been developed and maintained by Global Sources. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. |

Apparel

Search

Add Your Company

Contact Us

About Us

Advertise

News Letter

Legal

Help

Copyright © 1999-2023 Apparel Search Company. All Rights Reserved.