|

Sample pages |

| Executive summary | Industry overview | Supplier profile | Product gallery | |||||||||||||||||||||||||||||||||||||||||||||||||

| China accounted for approximately

30 percent of the world's output of children's wear in 2004. The

elimination of quotas resulted in a 30 percent surge in exports

in the first four months of 2005. However, it has also brought enormous

challenges to the industry, threatening to hinder growth.

After the two largest markets for China-made children's wear, the US and the EU, imposed safeguards on various types of apparel, China suppliers have had to explore other options to stay in business. Small companies producing low-end apparel have been the worst hit, as many of them work on thin profit margins and do not have the resources to survive.

Suppliers offer a range of styles in both these categories, mainly

because designs now follow adult clothing trends. Suppliers in China

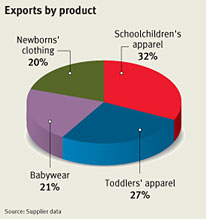

export four categories of children's wear Almost all children's wear manufacturers produce apparel for schoolchildren, and there are some that specialize in the line. More than 75 percent of suppliers featured in this report produce all four categories of children's wear for export, and almost 30 percent have schoolchildren's clothing as their main line. The Products & Prices section in this report discusses the main features of each category of children's wear and its price ranges. It also explains the differences among low-end, midrange and high-end models in each product category. Product development and design focus are discussed in the R&D/design section, while the Materials & Components module details the main types of fabric and accessories used by China makers. The Manufacturing section lists the key steps in children's wear production and how these differ in small, midsize and large companies. The majority of children's wear companies in China are locally owned, while a few are foreign-owned. Reflecting this structure, 76 percent of suppliers featured in this report are private locally owned, while 23 percent are private foreign-owned or invested.

And more... To see the full Executive Summary order now.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

| All information contained in China Sourcing Reports is the result of original, independent and impartial research conducted by Global Sources analysts. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. If you have questions about the report or status of your orders, please e-mail Xue Mei for further assistance. |

| The Children's Wear Sourcing report has been developed and maintained by Global Sources. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. |

Apparel

Search

Add Your Company

Contact Us

About Us

Advertise

News Letter

Legal

Help

Copyright © 1999-2023 Apparel Search Company. All Rights Reserved.