|

Sample pages |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Executive summary | Industry overview | Supplier profile | Product gallery | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China is the world's

leading supplier of home textiles, with exports in 2004 rising 24

percent to reach $4.7 billion. The elimination of quotas on certain

home textile products in January 2005 helped accelerate export growth

even further. Overseas shipments in the first five months of 2005

amounted to $2.2 billion soaring 40 percent year-on-year.

However, the steep rise in exports raised an alarm in the US and the EU, resulting in safeguard actions from the two regions. While China agreed to limit exports of bed and table linen to the EU, the US has begun investigating the surge in shipments of drapery. If the quotas are reinstated, the limits could be determined by the last quarter of the year. Similar action on bed linen is also possible from the US, as exports in the line increased by 77.6 percent in the period January to May 2005 from a year ago.

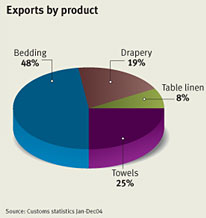

China's home textile exports are dominated by bedding, towels, table linen and drapery. Bedding, the largest line, totaled US$2.9 billion in exports in 2004 posting a year-on-year growth rate of 52.6 percent. These figures exclude quilted products. The second largest export category, towels rose to US$1.2 billion clocking a 16.5 percent growth rate, while drapery exports amounted to US$912 million, increasing 40 percent. Table linen raked in US$372 million worth of exports, growing moderately by 20.7 percent. These four product categories are also the scope of this report. The Products & Prices section discusses the features and prices of these major home textile types. The R&D/design module details the steps being taken by companies to improve functionality. Production and QC testing procedures in a typical home textile factory are discussed in the Manufacturing section. With more than 3,000 small, midsize and large suppliers, the home textiles industry in China is diverse and multifaceted. While most makers can produce several home textiles, many specialize in certain products. The Industry Overview section in this report elaborates on the industry composition, highlighting the key advantages of sourcing from different types of suppliers. And more... To see the full Executive Summary order now. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

| All information contained in China Sourcing Reports is the result of original, independent and impartial research conducted by Global Sources analysts. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. If you have questions about the report or status of your orders, please e-mail Xue Mei for further assistance. |

| The home textiles report has been developed and maintained by Global Sources. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. |

Apparel

Search

Add Your Company

Contact Us

About Us

Advertise

News Letter

Legal

Help

Copyright © 1999-2023 Apparel Search Company. All Rights Reserved.