| Higher raw

material costs and a growing supplier base are

intensifying competition in China's costume jewelry

export industry.

The prices of petroleum-based materials have been

escalating since2004 because of the higher cost of

crude oil in the world market. There has also been a

marginal increase in the cost of metal. With

sustained and significant increases in material

costs, the majority of costume jewelry manufacturers

in China have had to raise prices at the start of

2005 to offset higher expenses.

In fact, the average export value per gram of

costume jewelry exported from China in the first 10

months of 2005 increased 24 percent.

But while the higher average export value per

gram is mostly attributed to a general increase in

prices, an up market shift among suppliers is also a

factor.

With costume jewelry exports increasing at a

healthy rate in each of the past two years, new

manufacturers have been quick to join the industry.

The number of suppliers is expected to grow further

as the low-entry barrier attracts more companies to

the line.

With the supplier base growing, many of the more

established companies are moving up-market to

distinguish themselves and become more competitive.

Their years of experience in the line, financial

stability, and technical and design expertise have

helped them make the shift from low-end to midrange

and even high-end production. Some companies now

specialize in sterling silver models, many of which

are plated in 18K gold.

Although raw material costs are not expected to

stabilize in coming months, most manufacturers will

not raise prices in 2006. This is particularly true

for companies that have already implemented price

increases in 2005 and those that have moved up

market.

Industry composition

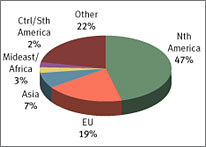

China is the world's foremost producer of costume

jewelry, accounting for about half of global supply.

Exports have been increasing in the past few years

and continue to show strong growth: Sales in the

first 10 months of 2005 grew more than 50 percent to

US$650 million. It is estimated that 70 percent of

the country's exports in the line go to OEM and ODM

customers.

Currently, about 60 percent of all costume

jewelry export volume in China is low-end, 30

percent midrange and 10 percent high-end.

About 70 percent of China's 5,000 costume jewelry

makers have export capability and of these, only

around 1,000 can ship products directly. The rest

export via the country's more than 1,500 trading

companies.

A richer sales experience, better service quality

and more distribution channels are some of the

advantages of sourcing from a trading company.

Because of these factors, small makers and entrants

may find it difficult to compete with trading

companies that have been long-term major players in

the industry.

However, products from trading companies are

usually 5 percent more expensive than when they are

sourced directly from manufacturers.

About 65 percent of costume jewelry makers are

small companies and around 90 percent are privately

owned. Large manufacturers account for no more than

5 percent of all exporters, and only about 10

percent are foreign-owned or joint ventures. The

majority of makers can produce all types of costume

jewelry, although a few concentrate on one or two

product lines.

And more... To see the full Industry Overview

order now. |