|

Sample pages |

| Executive summary | Industry overview | Supplier profile | Product gallery | |||

| Swimwear

suppliers in China are increasing their focus on

value-added and upscale designs as the low end of

the supply market continues to saturate. In

addition, companies are dealing with the labor

shortage and coming to terms with the US

restrictions on imports of China-made swimwear.

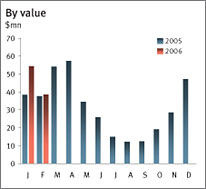

The large number of suppliers in the swimwear industry has resulted in intense price wars among makers. Competition has become especially fierce in the high-volume low-end segment, which is the focus for most of the 3,000 companies. Well-established suppliers, which make up 20 percent of the industry, and those that specialize in swimwear are able to offer the lowest export prices for swimwear in any price range. Smaller companies are, therefore, forced to keep up with price trends or upgrade their design capability to gain an edge. Even many of the large companies are moving to upscale manufacture to avoid price competition in the low end. Makers wanting to move to higher-end production are prioritizing enhancement of their R&D capability. They are expanding their product lines, improving the quality of swimwear and releasing new models more frequently. Many are also enhancing designs through value-added features including the use of performance fabric, better embroidery, special prints and more accessories. To aid in the development of new products and enhance manufacturing capability, these companies are investing in advanced equipment such as Gerber pattern-making machines, plotters and cutters from the US, and automatic printing machines from Japan. China's labor shortage is also a problem for many companies. The need for skilled workers is raising production expenses and affecting capacity. During off-season months when capacity runs at about 35 to 50 percent, suppliers usually ask some of their workers to take leave with basic pay. In these months, some of the workers are able to find better jobs that can guarantee higher income. Companies then find themselves short of workers during peak production months. Makers do have the option of hiring additional workers to ensure steady production during busy months. But doing so means investing time and money in training, especially because swimwear production is more complicated than most other garments. Safeguards imposed by the US, the largest importer of swimwear from China, is a challenge for some suppliers. The two countries signed a Memorandum of Agreement in November 2005 restricting imports of a number of garment and textile categories into the US, including swimwear. Even with export restrictions, companies shipping mainly to the US, especially the larger ones, will continue to do so. These makers still prefer to export to the US because of large volume orders from buyers that usually do not have difficult design requirements. Some suppliers, on the other hand, have set up offshore facilities in countries where there are no export restrictions. In fact, the US safeguard is a pressing problem only for smaller suppliers. These trade policies have made it difficult for some small companies to survive because of limited shipping capability and the increased cost of acquiring quota from large businesses with direct export rights. In response, some of the suppliers that used to focus on the US market have opted to explore countries and territories with no quota limitations, such as Eastern Europe, the EU and Asia. A number of them have even started shifting to other garments with no export restrictions. Industry composition The majority of swimwear makers in China are midsize companies that have between 300 and 800 workers, and monthly capacity of 200,000 to 400,000 pieces. Small companies generally have less than 300 workers and can produce 50,000 to 200,000pieces a month. Small and midsize suppliers offer mainly low-end and midrange models for export mainly to the Middle East, South America, Africa and Eastern Europe. And more... To see the full Industry Overview

order now.

|

|

||

|

||

|

|

| All information contained in China Sourcing Reports is the result of original, independent and impartial research conducted by Global Sources analysts. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. If you have questions about the report or status of your orders, please e-mail Xue Mei for further assistance. |

| The swimwear report has been developed and maintained by Global Sources. Apparel Search is working in association with Global Sources to help promote this sourcing report to the international fashion community. |

Apparel Search

Add Your Company

Contact

Us About Us

Advertise

News Letter

Legal

Help

Copyright © 1999-2023 Apparel Search Company.

All Rights Reserved.